How to Boost Your Credit Score and Manage Your Credit Cards Like a Pro

In the fast-paced digital age, financial management can become a labyrinth of complexities. Juggling credit card dues, payment deadlines, and transaction records is no small feat, and if not managed correctly may result in a poor Credit Score. The need for a revolutionary fintech solution that not only simplifies credit card management, improves credit score but also adds a touch of excitement through its unique rewards system was dire.

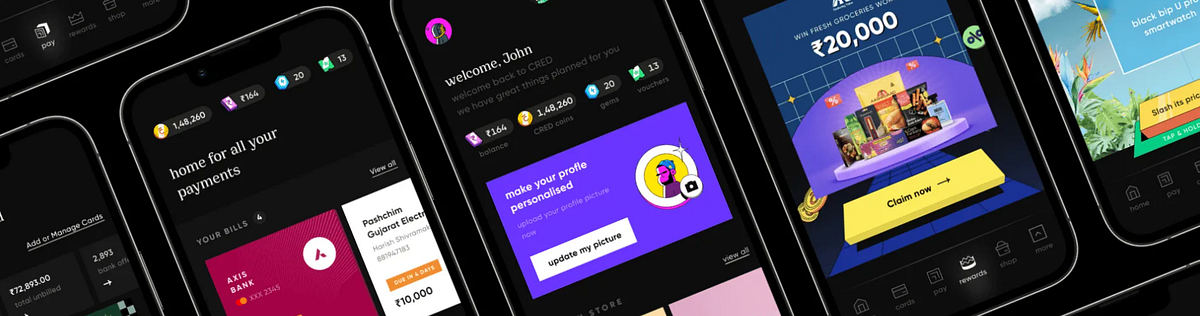

I would like to introduce you to an app that starts by addressing a common pain point: credit card management. With multiple credit cards, each having its own billing cycle and due dates, staying on top of payments can be challenging. An app that acts as a virtual assistant, consolidating all your credit card information in one place, providing a clear overview of your outstanding balances, upcoming due dates, credit score, and transaction history. This simplicity not only saves time but also helps you avoid late payment fees and interest charges.

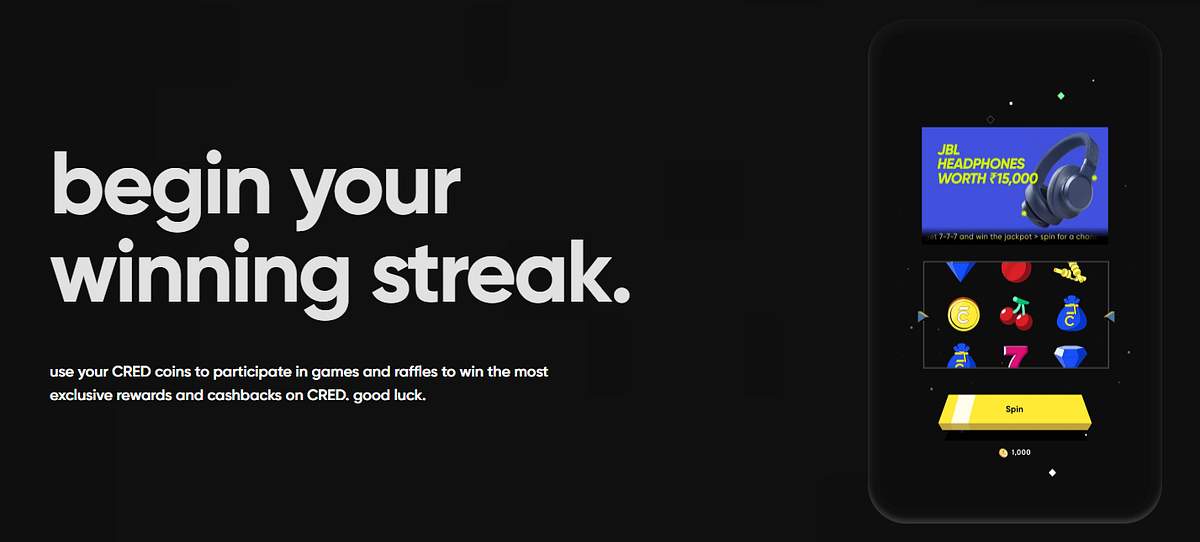

What’s even better is this app making your credit card payments an extremely rewarding experience through innovation! While most financial apps focus solely on transactions, this app takes it a step further by turning credit card management into a game. Each time you make a timely payment on the app, you earn rewards in terms of virtual coins and take a step towards improving your credit score. These coins can then be redeemed for an array of exciting offers, discounts, and products from top brands. It’s like getting rewarded for being financially responsible!

Let me introduce you to your Innovative Virtual Credit Card Assistant — CRED!

What is CRED?

CRED is an Indian fintech company based in Bangalore that offers a range of services related to credit card payments, rewards, and management. It is a members-only club that rewards individuals for their timely credit card bill payments by providing them with exclusive offers and access to premium experiences. It is a platform that allows credit card users to manage multiple cards along with an analysis of their credit score. Members with a high Experian or CRIF score are eligible for exclusive rewards upon payment of their credit card bills through the app. Among many of the features in the app are CRED’s credit card spend tracking and management feature which provided the user with analysis of spend tracking and efficiency of usage of the card.

CRED is also equipped with the CRED protect feature which is an AI-backed system that keeps track of every single nuance of a credit card payment journey — right from due date reminders, spend patterns, and other card usage statistics. Additionally, when a member makes a credit card payment through the app, they are eligible for a variety of rewards of various forms such as access to events, experiences, gift cards, and upgrades from brands like Diesel, Cure.Fit, Myntra, Olive Bar & Kitchen among many more. How to apply for a CRED membership? Since CRED is only for a select few, you can apply for membership by signing up with your full name and a valid Indian mobile number on the app. Once your credit score is checked by credit bureaus like CIBIL, Experian, and CRIF, and your score falls above the accepted eligibility score, you will be accepted as a member of CRED. Once you become a member, you will be able to access the curated set of exclusive rewards and privileges that are offered by CRED.

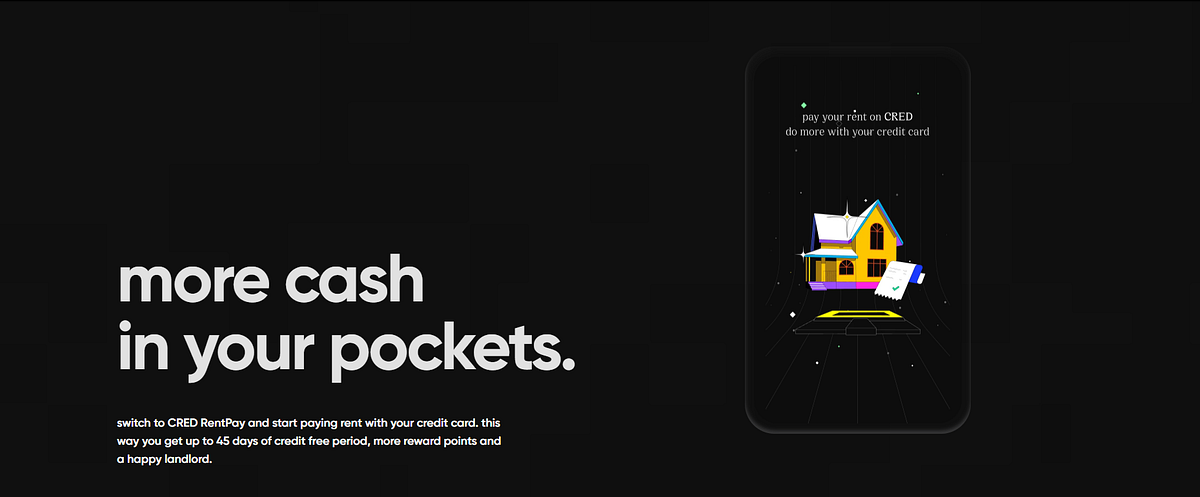

It was founded in 2018 by Kunal Shah and is a reward-based credit card payments app that lets users make house rent payments and provides short-term credit lines.

How does CRED empower you?

CRED goes beyond transactions by promoting financial education. Gain insights into your credit score, receive tips for improving your financial health, and learn responsible credit card usage. The app empowers users to make informed financial decisions and build a strong economic foundation for the future.

What are some of the rewards offered by CRED?

CRED offers exclusive rewards for paying your bills every time you pay your credit card bills on CRED, you receive CRED coins. You can use these to win exclusive rewards or get special access to curated products and experiences. Members can earn rewards in two different ways: CRED coins & and gems. When you pay your credit card bill on CRED, for every rupee cleared on your bill you earn a CRED coin. You can then use earned CRED coins to claim exclusive rewards from different brands.

CRED’s partnerships with various brands enhance the app’s value proposition. Redeem your CRED Coins for discounts on dining, shopping, travel, and more, making your responsible credit behavior even more rewarding. These collaborations provide diverse options for maximizing the benefits of the app.

What are the eligibility criteria to become a member of CRED?

To become a member of CRED, you need to have a credit score of 750 or above. This is checked through the phone number that is linked to the bank account.

Your credit score plays a significant role in your financial opportunities. The CRED app allows you to monitor your credit score effortlessly. By encouraging timely payments and responsible credit card behavior, CRED indirectly aids in improving your credit score over time. This feature alone can enhance your financial prospects.

What are the features of the CRED app?

The CRED app offers several features such as credit card payments, cashback on paying bills, earning CRED coins to redeem rewards, analysis of spending patterns, alerts on suspicious activities, alerts about inaccurate charges or unexpected fees, due date alerts, and auto-fetch due amounts.

Is CRED secure?

Protecting your financial information is a priority for the CRED app. Rigorous encryption and data protection measures ensure the security and confidentiality of your sensitive data. This commitment to security builds trust among users, making the app a reliable choice for managing your finances.

How can you sign up for CRED?

Here are the steps to sign up for CRED:

1. Click HERE to download the CRED app from the App Store or Play Store.

2. You can also Scan the QR Code below.

3. Sign up using your phone number.

4. Verify your credit score.

The CRED app reimagines credit card management as a user-friendly and rewarding experience. With its combination of technology, rewards, and financial education, it empowers you to simplify credit card handling and cultivate positive financial habits. Whether you’re a seasoned credit card user or new to financial management, the CRED app offers a valuable solution to simplify your financial journey while earning rewards along the way.

So what are you waiting for? Download the App and get started with the most rewarding credit card experience of your life!

Hope this article helped you!

If you liked what you read, Follow me and Contribute to my channel. It will encourage me to create more such posts and bring more ways to earn passive income for you.